Digital Banking Services Agreement Disclosure

Reviewed: February 2023

GENERAL TERMS AND CONDITIONS

This Digital Banking Services Agreement (“Agreement”) sets forth the terms and conditions governing the use of MSCU’s Digital Banking service. Please read Agreement completely and retain a copy with your personal records. By using, or allowing another person to use, the Digital Banking services offered by MSCU, you are agreeing to be bound by the terms and conditions contained herein. In this Agreement, the terms “you” and “your(s)” refer to the Member, and terms “we”, “our(s)” and “Credit Union” refer to Mutual Security Credit Union (MSCU).

All of the Services and transactions performed through this channel are subject to the agreements concerning your account, including but not limited to the Member Contract & Share Agreement and Funds Availability Policy.

Services Available Through Digital Banking

• Check balances

• Transfer funds between accounts

• Pay bills

• Deposit checks

• Review statements and other account information

• View your check images

• Place a stop payment on any check you wrote drawn from an MSCU account

• Add, change, and delete payments

• Cancel or modify future and recurring bill payments and transfers

• Make Person-to-Person payments

Electronic Communication

Your acceptance of this Agreement means that we may communicate with you electronically. From time to time, we may be required by law to provide you certain written notices or disclosures. These notices and disclosures may be sent electronically. Your use of the Services constitutes the acceptance of the electronic communications.

Email

You must have a valid email address on file in order to use MSCU’s Digital Banking service. You must keep us informed of your current address or email address to ensure correct mailing of monthly statements and to receive email notices related to servicing of your account. You may change your address or email address at any time within the Digital Banking Service. You may also contact us to make the change on your behalf. Our contact info is below.

Submissions

Please keep in mind that messages you send to us by e-mail may not be secure. DO NOT send any confidential or personal information (including but not limited to Account numbers, Social Security numbers, or any other confidential information) by Internet e-mail. MSCU will not be responsible for any damages you may incur if you communicate confidential or personal information to us over the Internet, or if we communicate such information to you, at your request.

Definitions

|

Business Day |

Refers to every day except Saturday, Sunday and Federal Holidays. |

|

Member / Consumer |

A natural person, which does not include a corporation, limited liability company or any other entity. |

|

Digital Banking; Electronic Banking; Online Banking; Mobile Banking |

Electronic delivery of banking products and services, including services to access accounts, conduct transactions or obtain information using a computer, mobile device, internet application, ATM, kiosk or touch tone phone. |

|

Mobile Device |

A supportable mobile device including a cellular phone or tablet with access to the internet. |

|

Mobile Deposit; Remote Deposit Capture (RDC) |

Refers to the act of making a check deposit by using your mobile device. |

|

Mobile Apps |

Apps designed to run on smart phones, tablet computers and other mobile devices. |

|

SMS Text Messaging |

Allows you to access available information via text messaging from your Device. |

|

Account(s) |

Means your eligible MSCU account that can be access via Digital Banking |

|

Substitute Check |

Means a paper check created from an electronic image, in accordance with the requirements of Federal Reserve Regulation CC.” |

Access and Authorizations

Access to MSCU’s Digital Banking service is provided over the Internet by personal computer and/or other devices. Access requires the use of a unique username and/or account number(s) together with a password or other security code or a combination of any of these items, or commonly known as your Login Credentials. Your use of MSCU Digital Banking with the Login Credentials will be deemed by us to be valid and authentic. You intend and agree that any communications to us under your Login Credentials will be given the same legal effect as written and signed paper communications and/or authorizations. You agree that electronic copies of communications are valid and you will not contest the validity of the originals or copies, absent proof of altered data or tampering.

Single Login ID per User

The Login Credentials are for the use of a single primary account holder. Primary account holders with Login Credentials can allow access to accounts they share with a Joint Owner by establishing each Joint owner their own set of Login Credentials. If you allow other to use your Login Credentials you will be liable for all activities of those individuals whether or not they act in a manner authorized by you and you agree to notify us in writing if you have withdrawn your authorization.

Service Requirements

To access your account you will need:

• a desktop or mobile device

• access to Internet via Internet Service Provider or mobile carrier Wi-Fi or data provider

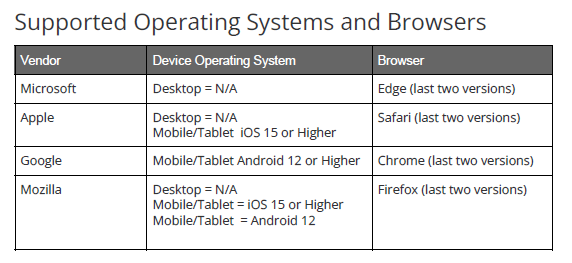

• One of the currently supported browsers noted below:

Mobile Banking requires access to the Apple or Android App Store

Mobile Deposit requires a device with a camera

You are responsible for the installation, maintenance and operation of any hardware, software, (including operating systems, browsers and mobile apps) required to access the Service. . We will not be responsible for any errors or failures involving any telephone service, online service, or software installation on your computer or mobile device. The Digital Banking Service is normally accessible seven (7) days a week, twenty-four (24) hours a day with the exception of short periods for scheduled maintenance, upgrades and/or circumstances beyond our control.

The Service may not be available through all service providers and carriers, and personal computing equipment and software may not be supported. The technical standards required to access and use the Service may vary among the types of Internet Service Providers (ISP’s), and/or wireless carrier.

Your Obligations

When you use the Digital Banking Service to access your Accounts, you agree to the following:

♦ Account Ownership/Accurate Information. You represent that you are the legal owner of the accounts and other financial information which may be accessed through the Service. You represent and agree that all information you provide to us in connection with the Service is accurate, current and complete, and that you have the right to provide such information to us for the purpose of operating the Service. You agree to not misrepresent your identity or your account information.

♦ Proprietary Rights. You are permitted to use content delivered to you only in connection with your proper use of the Service. You may not copy, reproduce, distribute, or create derivative works from this content.

♦ User Conduct. You agree not to use the Service or the content or information in any way that would:

• Be fraudulent or involve the sale of counterfeit or stolen items, including, but not limited to, use of Digital Banking to impersonate another person or entity;

• Be false, misleading or inaccurate;

• Potentially be perceived as illegal, offensive or objectionable; or

• Violate any law, statue, ordinance or regulation (including, but not limited to, those governing export control, consumer protection, unfair competition, anti-discrimination or false advertising).

Further, you agree to:

• Take every precaution to ensure the safety, security and integrity of your Accounts and transactions when using Digital Banking. Should you provide your Login Credentials to any other person; we will not be liable for any damage resulting to you; and

• Notify us immediately if you no longer have any mobile device which you use to access any of the Digital Banking services. If you believe that someone may have unauthorized access to your Digital Banking account or your personal computing device used to access your accounts, you agree to contact MSCU immediately. You agree to comply with all applicable laws, rules and regulations in connection with these services.

• You agree not to provide your password or other access information to any other person. If you do, we will not be liable for any damage resulting to you. Failure to notify us immediately could result in the loss of all money, including any credit lines or overdraft lines.

• You agree not to leave your personal computing device unattended while logged on to the Service and to log off immediately at the completion of each access by you

• You are responsible for keeping all Account and login information private and ensuring that you do not download viruses or malicious software that could put your confidential information at risk.

• To the extent that we or our service providers require information about you in order to provide Digital Banking Service, you hereby consent to the exchange of such information between us and such service providers.

♦ No Commercial use or Re-Sale. You agree that the Service is for personal use only. You agree not to resell or make commercial use of the Digital Banking Service.

MSCU reserves the right to employ "cookie" technology as a prerequisite for your use of the Service. You must allow the use of "cookies" or the Service may not function as intended.

Amendment, Termination or Suspension of Services

Except as otherwise required by law, we may in our sole discretion change these terms, and modify or cancel the Service, features we offer, from time to time and at any time, without notice. This may include adding new or different terms to, or removing terms from, this Agreement. When changes are made we may update this Agreement on www.mscu.net. The disclosure may be updated on or before the effective date, unless (i) the service provider has made a modification and did not provide Mutual Security with advance notice; or (ii) an immediate change is necessary to maintain security or to prevent fraud; or (iii) a legal requirement requires immediate change; in which event this Agreement will be updated within a commercially reasonable period of time.

By continuing to use the Service after such change, you agree to the change. We may terminate or suspend all or any part of the Service at any time, in our discretion, without notice to you, and without liability to you. No termination of the Service or any part thereof will affect your liability or obligations under this Agreement accruing prior to the date of termination or any provisions of this Agreement which, by their nature or by express provision, are intended to survive termination. When you use or otherwise activate the Service, and each time you use or allow others to use the Service, you confirm your agreement to abide and be bound by the terms and conditions of the Service and this Agreement as in effect at that time. MSCU may limit the types and number of accounts eligible for the Service at any time. You shall immediately install any upgrades, patches or fixes required for security reasons or otherwise for the proper functioning of the Service, regardless of whether requested by us or our service providers.

Eligibility and Use of the Service

In order to access the Service, you must (a) be a registered user of MSCU’s Digital Banking Service with an activated and approved Membership Account. In order to use the services, you must be eligible for, and must enroll in the Service. As part of the enrollment process, you may be required to provide verification information for us to positively identify you and the verify email address you have designated in connection with your use of the Service. You must designate a username, Password, and any other such “login codes” that we require in order for you to authenticate. MSCU reserves the right to change the types of login codes needed in order to access our services, and also reserves right to limit the account(s) which you can view, transact on, and otherwise access, including the right to allow or disallow access to the Service altogether with no duty to you to disclose any reason(s) why we shall do so. You must be a member of MSCU or must be acting in a fiduciary capacity on behalf of one of our members in order to access the Service. As outlined in our Member and Share Deposit Account Agreement, you must positively identify yourself according to all State and Federal regulations which are not under the control of MSCU. We reserve the right to refuse to accept any person or entity as a user for any reason at our sole discretion and to limit the types and/or dollar amount(s) of any transactions you can perform using any of Services.

Our Digital Banking Services are provided to you "AS IS" without any warranty. MSCU DISCLAIMS ALL WARRANTIES, WHETHER EXPRESS, IMPLIED OR STATUTORY, INCLUDING WITHOUT LIMITATION IMPLIED WARRANTIES OF MERCHANTABILITY, SATISFACTORY QUALITY, AND FITNESS FOR A PARTICULAR PURPOSE, ACCURACY, TIMELINESS, AND NON-INFRINGEMENT OF THIRD PARTY RIGHTS. You release MSCU, its service providers, affiliates and all other parties from all claims and damages that may arise from or relate to your use of any Digital Banking Services. You agree not to reverse engineer, decompile, disassemble or attempt to learn the source code of any Service, and you may not redistribute any Service. It is your responsibility to provide us with accurate, complete and current information about you, and to notify us immediately if any of this information changes. We reserve the right to refuse or cancel your registration for the Service if we cannot verify information about you. Access to the Service requires the use of Login Codes, and all terms and conditions in the Agreement relating to Login Codes apply to the use of Login Codes for all of the Service.

You accept responsibility for making sure that you understand how to use the Service before you actually do so, and then that you always use the Service in accordance with online instructions posted on any of our Online Electronic Services. You also accept responsibility for making sure that you know how to properly use your personal computing device and the Service, including the Mobile Application, as they may be changed or upgraded from time to time. MSCU may change or upgrade the Service from time to time. In the event of such changes or upgrades, you are responsible for making sure you that you understand how to use the Service as changed or upgraded.

Fees

There is no fee for the Digital Banking Services; however, you are solely responsible for the payment of any internet access charges, wireless access, data charges and text messaging fees from your service provider.

Online Electronic Services Limitations

It is important that you understand the limitations of the Service, including but not limited to the following:

• The balance of your accounts may change at any time as we process items and fees against your accounts, and the information provided to you through the Service may become quickly outdated.

• Because the Service is accessible only through your personal computing device(s), your access to the Service may be limited by the Service provided by your ISP or telecommunications carrier.

• There may be technical or other difficulties related to the Service. These difficulties may result in loss of data, personalized settings or other the Service interruptions.

• Neither MSCU nor its service providers assume any responsibility for the timeliness, deletion, or misdelivery of any user data, failure to store user data, communications or personalized settings in connection with your use of the Service; nor for the delivery or the accuracy of any information requested or provided through the Service.

• Neither MSCU nor any of our service providers assumes responsibility for the operation, security, functionality or availability of Internet Service Provider or other such network which you utilize to access the Service, nor guarantee that you will have continuous or uninterrupted access to the Service.

We are not responsible for any delay, failure or error in the transmission or content of information provided through the Service. Neither we nor any of our service providers and affiliates will be liable for damages arising from the non-delivery, delayed delivery, or improper delivery of any information through the Service, from any inaccurate information provided through the Service, from your use of or reliance on any information provided through the Service, or from your inability to access the Service.

We will not be liable to you for any losses caused by your failure to properly use the Services. We reserve the right to refuse to make any transaction you request through the Service for any reason. You agree and understand that the Service may not be accessible or may have limited utility over some communication networks, such as while you are not in the United States of America. You agree to exercise caution when utilizing the Service and to use good judgment and discretion when obtaining or transmitting information.

Financial information obtained through the Service reflects the most recent account information available through the Service and may not be accurate or current. You agree that neither we nor our service providers will be liable for any errors or delays in the content, or for any actions taken in reliance thereon.

You understand that the Service is provided by MSCU through a Licensor, and MSCU shall not be liable to you for any modification, interruption or termination of all or any portion of the Service due to the acts or omissions of the service provider.

Security & Protecting your Account

Once you have accessed and/or registered for the Service, your personal computing device may be used to obtain information about your Accounts, and perform transactions on and make transfers between your Accounts. You are responsible for maintaining the security of your device and you are responsible for all transfers and payments made. The Service will display sensitive information about your Accounts, including balances and payment/transfer amounts. Anyone with access to your personal computing device may be able to view this information.

In order to prevent misuse of your accounts through the Service, you agree to protect all Login Codes associated with your accounts and the Service, and to monitor your accounts on a daily basis. In addition to protecting your Login Codes and other account information, you should also take precautions to protect your personal identification information, such as your driver's license, Social Security Number, etc. This information by itself or together with other account information may allow unauthorized access to your accounts. You are also responsible for protecting and securing all information and data stored in your personal computing device, including but not limited to the use of a security code or other such locking mechanism that may be available to you for your use on your personal computing device in order to prevent others from accessing the Service.

We are not liable for any damages or disclosure of information to third parties due to your inability to ensure the security and integrity of your account and transactions when using Mobile Banking. Notwithstanding our efforts to make Mobile Banking secure, you acknowledge that the Internet is inherently insecure and that certain types of mobile communications (such as text messages) are not encrypted and can potentially be read by others.

You acknowledge and agree that MSCU has no obligation to confirm the identity or authority of any person using your Login Credentials. Accordingly, the Login Credentials that you use to gain access to MSCU Online Banking should be kept confidential and must not be disclosed to any person whom you do not authorize to access our account information.

To avoid unauthorized access to your personal or financial information, you agree to adopt all reasonable security measures in using MSCU’s Online Banking, including, but not limited to the precautionary steps listed below:

• Do not reveal your Login Credentials to anyone else;

• Avoid selecting Login Credentials based on personal information that may be determined or accessible by others such as names, birthdays, addresses, or that are similar to your other existing passwords, PINs or security credentials;

• Do not leave your computer unattended when connect to the Service;

• After completing any activities, exit the Service by properly logging out;

• After completing any activities, you should secure or erase any files that may exist in a non-encrypted on your device to prevent unauthorized access;

• Do not send any personal, financial or account information by Internet , as messages sent in this manner are sent outside areas of the website using encryption;

• You will verify that your online session is encrypted with 128-bit SSL encryption;

• Check your account regularly and immediately report and suspicious activity to MSCU. Early detection is critical;

• Avoid downloading “free” software; downloads are a common source of “spyware” infections. Scan your PC and/or other Mobile Device with your anti-virus software on a regular basis to check for new viruses or spyware that may have been missed initially;

• Fraudsters may use official-looking e-mails and websites to lure you into revealing confidential financial information. The messages appear to be from trusted banks, retailers or other companies. Be suspicious of any e-mail with urgent requests to “verify account information.” When in doubt, call the sender directly and validate the message. The safest measure is not to click on links received via e-mail from anyone.

• Make sure you access the site directly at www.mscu.net instead of clicking on links in e-mails that may be disguised as MSCU;

• Only download apps from trusted App Store.

Links to Other Sites

MSCU’s website may contain links to third party sites. These links are provided for convenience purposes only. If you choose to utilize the links to such third party websites, MSCU makes no warranties, expressed, implied or statutory, concerning the content of such sites. MSCU does not warrant that such sites or content are free from any claims of copyright or other infringement or that such websites or content are devoid of viruses or other contamination. MSCU disclaims all liability of any kind whatsoever arising out of your use of, or inability to use such third party websites, the use of your information by such third parties, and the security of information you provide to such third parties. Third party websites are not under the control of MSCU. Links to non-MSCU sites do not imply any endorsement of or responsibility for the opinions, ideas, products, information or services offered at such sites, or any representation regarding the content at such sites. Further, descriptions of, or references to, products, services, or publications of third parties within MSCU’s website do not imply endorsement of any third party's product, service or publication.

It is important for you to take necessary precautions to ensure appropriate safety from viruses, worms, Trojan horses, and other potentially destructive items. When visiting external websites, you should review those websites' privacy policies and other terms of use to learn more about how they collect and use any personally identifiable information.

Copyright Notices

The works of authorship contained in MSCU’s website, including but not limited to all design, text, sound recordings, icons and images, are owned, except as otherwise expressly stated, by MSCU. Except as otherwise expressly stated, the works contained in MSCU’s website may not be copied, transmitted, displayed, performed, distributed (for compensation or otherwise), licensed, altered, framed, stored for subsequent use or otherwise used in whole or in part in any manner without MSCU’s written consent. Nothing from MSCU’s website may be modified, sold, transferred, or used by you for commercial purposes. Any downloading, printing or copying from a MSCU’s website must be for your personal use only.

Governing Law

All Agreements and Disclosures shall be construed in accordance with Federal Law and the State of Connecticut law where MSCU has its home office. You agree to pay MSCU all of our costs and reasonable attorney’s fees, including all collection costs, litigation costs and outside service fees incurred while we are enforcing our rights under this Agreement.

Exclusion of Warranties; Limitation of Liability

Limitations on Mutual Security's liability are described in the Member and Share Deposit Account Agreement, Funds Availability Policy, EFT Agreement, and any Addendums to this Agreement. In addition:

YOU EXPRESSLY UNDERSTAND AND AGREE THAT YOUR USE OF the Service IS AT YOUR SOLE RISK. THE SERVICE IS PROVIDED ON AN "AS IS" AND "AS AVAILABLE" BASIS. ANY MATERIAL DOWNLOADED OR OTHERWISE OBTAINED THROUGH THE USE OF THE Service IS OBTAINED AT YOUR OWN DISCRETION AND RISK, AND MSCU IS NOT RESPONSIBLE FOR ANY DAMAGE TO YOUR PERSONAL COMPUTING DEVICE OR LOSS OF DATA THAT RESULTS FROM THE DOWNLOAD OF ANY SUCH MATERIAL, WHETHER DUE TO ANY COMPUTER VIRUS OR OTHERWISE. MSCU MAKES NO REPRESENTATION OR WARRANTY AS TO THE COMPLETENESS, ACCURACY, RELIABILITY, OR CURRENCY OF ANY THIRD PARTY INFORMATION OR DATA THAT YOU OBTAIN THROUGH THE USE OF the SERVICES NO ADVICE OR INFORMATION, WHETHER ORAL OR WRITTEN, OBTAINED BY YOU FROM MSCU OR THROUGH OR FROM YOUR USE OF the Service WILL CREATE ANY WARRANTY OR REPRESENTATION NOT EXPRESSLY STATED IN THESE TERMS.

YOUR SOLE AND EXCLUSIVE REMEDY FOR ANY FAILURE OR NON-PERFORMANCE OF the Service (INCLUDING ANY SOFTWARE OR OTHER MATERIALS SUPPLIED IN CONNECTION WITH the Service) SHALL BE FOR US TO USE COMMERCIALLY REASONABLE EFFORTS TO CORRECT THE APPLICABLE ONLINE ELECTRONIC SERVICES.

Some jurisdictions do not allow the exclusion of certain warranties, so the above exclusions may not apply to you. You may also have other legal rights, which vary by state.

Indemnification

YOU AGREE TO INDEMNIFY, HOLD HARMLESS AND DEFEND US, OUR OFFICERS, DIRECTORS, EMPLOYEES, MEMBERS, SHAREHOLDERS, PARENTS, SUBSIDIARIES, AFFILIATES, AGENTS, LICENSORS AND SERVICE PROVIDERS FROM AND AGAINST ANY AND ALL THIRD PARTY CLAIMS, LIABILITY, DAMAGES, EXPENSES AND COSTS (INCLUDING, BUT NOT LIMITED TO, REASONABLE ATTORNEYS FEES) CAUSED BY OR ARISING FROM YOUR USE THE DIGITAL BANKING SERVICES BY ANY OF YOUR CO-DEPOSITORS OR ANY OTHER PERSON WHOM YOU HAVE PERMITTED TO USE THE SERVICES, YOUR BREACH OF THIS AGREEMENT, YOUR INFRINGEMENT, MISUSE OR MISAPPROPRIATION OF ANY INTELLECTUAL PROPERTY OR OTHER RIGHT OF ANY PERSON OR ENTITY, AND/OR YOUR COMMISSION OF FRAUD OR ANY OTHER UNLAWFUL ACTIVITY OR CONDUCT.

Limitation of Liability

I understand and agree that you will not be liable for any direct, indirect, incidental, punitive, special, consequential or exemplary damages, including, but not limited to damages for loss of profits, goodwill, use, data or other losses resulting from or attributable to the use of the inability to use the Services incurred by me or any third party arising from or attributable to the use of, inability to use, the termination of the use of the Services, or your breach of this disclosure and agreement, regardless of the form of action or claim (whether contract, tort, strict liability or otherwise), even if you have been informed of the possibility thereof.

Severability

A determination that any provision of this Disclosure and Agreement is unenforceable or invalid shall not render any other provision of this Disclosure and Agreement unenforceable or invalid.

Damages

Except as otherwise provided expressly by law, in no event shall MSCU or its Officers, Directors, Employees or Agents be liable to you for any loss including, without limitation, loss of data, injury or damages, whether direct, indirect, special, incidental, exemplary or consequential, including lost profits arising out of or related to this Agreement or the subject matter herein even if we have been advised of the possibility of such loss, injury or damages. You agree to hold MSCU harmless for any such loss, injury or damages. Some jurisdictions do not allow the exclusion or limitation of implied warranties or liability for incidental or consequential damages, so the above exclusions or limitations may not apply to you.

Termination

You may terminate this Agreement with us at any time. MSCU reserves the right to terminate this Agreement and/or your use of the Mobile Banking and Mobile Deposit services at any time with or without cause. We may do so immediately if:

• You or any authorized signer on your account breaches this or any other agreement with MSCU;

• We have reason to believe that there has been or might be an unauthorized use of your account; or

• You or any authorized signer on your account requests that we do so.

Miscellaneous

Consent to Use of Data - You agree that MSCU may collect information about your personal computing device, system and application software in connection with offering and operating the Service and to enhance your experience when using our Digital Banking Services. To read our Privacy Notice, visit www.mscu.net.

We reserve the right to block access or delete the Service software from your personal computing device if we or our agents or the service providers have reason to believe you are misusing the Service or are otherwise not complying with this Agreement and/or its Addendums, or have reason to suspect your personal computing device has been infected with malicious software or virus.

MSCU is not responsible for translating any of the information contained within the Service to any other language and we are not responsible for the accuracy of any third party translating services.

Support: For assistance with our Digital Banking Services, you may:

• Use the “Message Center” to send a secure message

• Call us at 1-800- 761-2400

• Visit a local MSCU branch.

• Do not attempt to communicate with a MSCU representative via email, SMS Text Messaging or any other form of unencrypted electronic message.

You are responsible for your own acquisition, upkeep and management of your personal computing devices. Further, you are responsible for procuring your own network or cellular connections. MSCU does not provide internet or cellular connectivity or the devices associated with the use of this service.

You are responsible for the accuracy of your data entry and use of the application when accessing accounts and conducting transactions. MSCU is not liable for errors caused by your misuse or error. This includes any error caused by "pre-filling" or automated entry done on your behalf by the device, system or application software.

You are responsible for keeping all account and login information private and ensuring that you do not download viruses or malicious software that could put your confidential information at risk.

MSCU maintains the right to contact you via your personal computing device as a means to relay important account information or information about the use of the Service for as long as you are enrolled in the Service.

We specifically do not warrant that the Service will function in any foreign countries.

Force Majeure

You agree that MSCU is excused from performance of our obligations under this Agreement to the extent that MSCU is prevented or delayed from performing our obligations due to causes that are beyond our control, including but not limited to, acts of God, your acts or omissions, acts to any government or regulatory body (whether civil or military, domestic or foreign, fires, explosions, floods, earthquakes, floods or other natural or manmade disasters, epidemics, sabotage, wars riots, civil disturbances, strikes, lockouts, labor disputes, loss of electrical or other power or telecommunications equipment or line failures (each a “Force Majeure Event”). Our responsibilities under this Agreement will resume as soon as reasonably possible after the Force Majeure Event has expired.

Privacy

Your access or use of MSCU’s Digital Banking constitutes your agreement to the terms and conditions of our Privacy Notice and our use of information gathered about you in accordance with that Notice. Our Privacy Notice may be revised occasionally and can be reviewed by visiting www.mscu.net at any time. Your continued use of MSCU’s Digital Banking following such notification or posting will constitute your acceptance of the revised Privacy Notice. Accordingly, please check back regularly for revisions. We will provide notice of changes to our Privacy Notice as required by law.

MSCU may collect and use the information described below about your Internet connection and usage whenever you visit MSCU’s website:

• The dates and times that you access MSCU’s website;

• The web pages you visit;

• If you link to MSCU’s website from other websites and the address(es) of the other websites;

• The types and versions of browser and operating systems you use to access MSCU’s website;

• The Internet Service Providers ("ISP") and Internet Protocol ("IP") addresses from which you access MSCU’s website (an IP address is a number that is automatically assigned to your computer whenever you are surfing the web); and

• The actions you try to perform (for example, downloading a document) and whether you are successful.

MSCU may use this information to provide the Digital Banking Services to you and, among other purposes, to measure the number of visitors to MSCU’s website and web pages, and to help make MSCU’s websites more useful.

Third Party Beneficiaries

You agree that our service providers may rely upon your agreements and representations in this Agreement, and such service providers are third party beneficiaries of such agreements and representations, with the power to enforce those provisions against you, as applicable and as the circumstances or context may require.

ONLINE BILL PAY SERVICE

Our Service allows you to pay your bills online by enrolling in Online Bill Payment service and designate a funding (checking) account. You may make payments to any Payee (person or business) that has a verifiable payment address within the United States We reserve the right to refuse to accept any person or entity as a Payee for any reason at our sole discretion and to limit the dollar amount payments.

Instructions for Setting up Payees & Payments

Simply click the +Payee button and follow the on-screen prompts for selecting the payee type and then completing the requested information.

To initiate payment, locate the payee that you wish to pay and then enter in the appropriate information.

Single Payments: A single payment will be processed on the business day that you designate as the payment processing date, provided the payment is submitted prior to the daily cut-off time on that date.

A single payment submitted after the cut-off time on the designated process date will be processed on the next business day. If you designate a non-business date as the payment processing date, the payment will be processed on the first business day following the designated processing date.

Recurring Payments: Payments will be managed by system according to your selected frequency settings. If the calculated processing date is a non-business date, the payment is adjusted to the first business date prior to the calculated processing date.

Note: If your frequency settings for the recurring payment specify the 29th, 30th, or 31st as a particular day of the month for processing and that day does not exist in the month of the calculated processing date, then the last calendar day of that month is used as the calculated processing date.

Single and Recurring Payments: The system will calculate the Estimated Arrival Date of your payment. This is only an estimate, so please allow ample time for your payments to reach your Payees.

If a Payee is set up to receive payments electronically, we will send the payment electronically and your account with the merchant can be credited quickly. To ensure your merchant has adequate time to credit your account, we would recommend that you submit payments a minimum of 5-6 business days BEFORE the due date.

If a Payee is not set up to receive payments electronically, a paper check for the amount of your payment from your account(s) will be mailed to the address you gave us when you asked us to set up the Payee.

You agree to ensure that your account has sufficient available funds to cover any Bill Payment you initiate. If there are insufficient funds in your Checking Account on the day a Bill Payment is scheduled, your account may become overdrawn and subject to fees.. The amount of the overdraft fee is listed in our current Fee Schedule(s) related to the account(s) used to fund these transactions.

Any bills you have authorized for payment today or for future dating will appear in the PENDING section of the Bill Payment window and will remain there until the cut off time on the processing day.

Should you request the Service to be canceled, any payment(s) the Service has already processed before the requested cancellation date will be sent. All Scheduled Payments including recurring payments will not be processed once the Service is canceled. The Service may terminate or suspend Service to you at any time.

E-Bill Services

Our Service offers Bills to be received electronically... Once your Billers are added, billing statements will appear after they are issued, and you will be able to make payments to your Billers through Bill Pay. When you activate e-bill for your Billers, we either will notify the Biller of your request to receive e-bills, or use your username and password to obtain your e-bill pursuant to your authorization as described below. The presentment of your first e-bill may vary from Biller to Biller and may take as much as sixty (60) days, depending on the billing cycle of your account with each Biller. Additionally, your continuing receipt of a paper copy of your billing statement(s) is at the sole discretion of the Biller. While e-bill is being activated, it is your responsibility to keep your accounts with your Billers current. Each of your Billers may reserve the right to accept or deny your request to receive e-bills.

Your Authorizations

Your activation or/use of e-bill for the electronic presentment of e-bills from your Billers will be deemed by us to be your authorization for us to obtain e-bill data from the Biller on your behalf. For some Billers, we will access your billing data from the Biller pursuant to our agreement with the Biller. For other Billers, you will be asked to provide us with confidential sign-on information, such as your username, password, and other personal data that is necessary to set up an e-bill. By providing us with your sign-on information, you authorize us to use your sign-on information to access your Biller’s websites and to obtain your billing information from your Billers, and you appoint us as your agent for the purpose of setting up e-bills. You further authorize us to make your e-bill payments by electronic, paper, or any other means that we deem appropriate.

Updating Your Information

We are unable to update or change your personal information such as, including but not limited to your name, address, telephone number, e-mail address, password and username that you provide to your Billers. If you update or change any of your information, you will need to make those changes by contacting your Billers directly. You also agree not to use someone else’s information to gain unauthorized access to another person’s accounts with the Billers. You hereby authorize us to provide to the Biller your e-mail address, service address, or other data specifically requested by the Biller at the time of activating the electronic file for that Biller, for purposes of the Biller informing you about e-bill and/or billing information.

Notifications

You may set up e-mail Alerts so that you receive an Alert when your e-bill arrives and an Alert when payment is due. Notifications and reminders are solely for your convenience; it is your responsibility to maintain an accurate e-mail address and to logon to check for the delivery or status of your e-bills. We will present all of your e-bills as we receive them from Billers.

Cancellation of E-Bill Service

Your Biller may reserve the right to cancel the presentment of e-bills at any time. If any of your Billers do so, you will receive your bills in a paper form by mail, and you will not receive and will not be able to pay those bills through e-bill. You may cancel the e-bills from your Billers at any time. The timeframe for cancellation of your e-bills may vary from Biller to Biller, and it may take as much as sixty (60) days, depending on the billing cycle of each Biller. Through e-bill we will notify your electronic Biller(s) as to the change in status of your account and it is your sole responsibility to make arrangements for an alternative form of bill delivery. We will not be responsible for presenting any electronic bills that are already in process at the time of cancellation. We reserve the right to terminate, modify or change e-bill and we will notify you of any such termination, modification or change as required by applicable law.

Non-Delivery and Copies of E-Bill(S); Billing Records

You agree to hold us harmless if a Biller fails to deliver your e-bills to us. You are responsible for ensuring timely payment of all of your e-bills. Although e-bill will retain your e-bill information, you should also save your e-bill information to your computer’s hard drive.

Accuracy and Dispute of Electronic Bill

We are not responsible for the accuracy of your e-bills. We are only responsible for presenting to you the e-bill information we receive from your Billers. Any discrepancies or disputes regarding the accuracy of your e-bills must be addressed by you with your Billers directly.

Privacy

When e-bills are set up with your Billers, you will provide certain information to us that will be forwarded to your Billers to complete the setup of the e- bills. If you have any questions concerning the future use of that information, you should contact your Billers directly.

Agreements with Billers

You must be registered with each Biller for online access to your Billers websites and/or to receive online bills from your Billers, and you must review the Billers instructions and disclosures for receiving online bills. This Agreement does not alter your liability or obligations that exist between you and your Billers, such as your account agreements, the Billers’ instructions for online bills, and the Billers website terms and conditions. You acknowledge and agree that you are solely responsible for determining whether e-bill does or does not comply with the terms and conditions of your agreements with your Billers.

In order to access the Service, your Checking Account, must be in good standing and submit one time enrollment request.

Additional Bill Pay support is available during business hours via online chat.

No international payments.

EXTERNAL TRANSFERS (FI-to-FI)

You may utilize the Service to transfer funds between your MSCU account and certain personal deposit or investment accounts at other financial institutions.

Account(s) Set-up and Scheduling an External Transfers

You will need to set up and verify each of your non-MSCU accounts that you wish to use for these transfers. You agree that you will only attempt to set up and verify personal accounts which you own individually or jointly and for which you have the authority transfer funds. You should not set up any accounts for external funds transfers which you do not own or for which you do not have authority to transfer funds. If you attempt to set up an ineligible MSCU account for External Transfers, you will not be permitted to do so.

An inbound transfer moves funds into an account at MSCU from an account outside MSCU. An outbound transfer moves funds from an account at MSCU to an account outside MSCU.

International transfers are not supported.

Transfers can be scheduled on either a one-time or recurring basis. The recurring transfer feature may be used when a set amount is transferred at regular intervals. For example you may schedule a $100 transfer from an account you own at another financial institution to your MSCU checking account every week.

The cut-off time for external transfer is 2: 00 PM ET. Any external transfer initiated after this time will be considered as being initiated on the Next Business Day. External Transfers will appear in the Scheduled Transfers list until the processing cycle begins. Outbound Transfers may be subject to longer availability by the receiving financial institution.

Processing of one-time external transfers may be initiated immediately or scheduled for initiation at a future date. Future-dated or recurring external transfers scheduled for a weekend or non-business day will be processed on the Next Business Day.

Future-dated and recurring external transfers can be edited or canceled prior cut off time of 2:00 PM ET.

Transaction Limits, Cutoff Time and When Your Funds Will Be Available

|

|

Transaction Limits |

Transferred Funds Available |

Cut Off Time |

|

Outbound Transfer |

$3,000.00 per day |

Funds may be unavailable for up to three (3) Business Days after the date of transfer. Receiving institution may have longer availability. |

Transfers initiated after 2:00 pm ET will be processed Next Business Day. |

|

Inbound Transfer |

$3,000.00 per day |

Funds may be unavailable for up to three (3) Business Days after the date of transfer request. |

Transfers initiated after 2:00 pm ET will be processed Next Business Day. |

The above limits apply to outbound and inbound external transfers for all accounts. Any external transfer initiated on a day that is not a Business Day counts toward the applicable limit for the Next Business Day. We may change your dollar limits at any time. Any decrease will be subject to notice as required by law, but you agree that we may reduce your limits stated above without prior notice upon occurrence of a Disqualifying Event described below.

External transfers are available to consumer customers, but you agree we may cancel, without prior notice, upon occurrence of a Disqualifying Event.

Each of the following is a Disqualifying Event:

• Any of your deposit accounts with MSCU are not in good standing.

• You have an overdraft, an over-limit item, or an item returned for insufficient funds with respect to any MSCU deposit account during the current or three (3) prior statement cycles.

External Transfers Processing

MSCU will process external transfers on your behalf by means of the Automated Clearing House (ACH) network pursuant to this Agreement and the rules of the National Automated Clearing House Association (NACHA). We can reject an external transfer if it is not in compliance with the NACHA rules. Under NACHA rules, any credit to your MSCU account or your account at a third party financial institution shall be provisional until such credit has been finally settled by us or by the third party financial institution holding your account. You acknowledge that you have received notice of this requirement and of the fact that if we do not receive final settlement for an external transfer for any reason, we shall charge back the amount of such transfer from the account being debited or the account being credited, as applicable, or any other of your accounts or claim a refund from you.

You agree that you are authorized to initiate every inbound or outbound transfer you request in the amount requested. You also agree that your authority is operative at all relevant times including without limitation at the time you set up the transfer and at the time that we initiate the debit or credit to your MSCU account.

You agree that you will have sufficient funds available in the designated deposit account to cover your payment obligations under this Agreement. In the event that there are not sufficient funds available in your deposit account to cover your payment obligation, you agree that we may offset, without prior notice or demand, any account held by you to the extent permitted by law. If the deposit account does not have sufficient available funds on the scheduled date, we may elect not to initiate one or more of the transfers. If we do elect to initiate the transfer, it may cause an overdraft in your account in which case you shall be liable for the overdraft and any overdraft fees, as set forth in the MSCU Fee Schedule.

You are solely responsible for the accuracy and completeness of external transfer instructions provided to us. MSCU is not responsible for any errors in the external transfer instructions or requests for cancellation or change to instructions provided by you to MSCU.

You are solely responsible for the accuracy and completeness of external transfer instructions provided to us. MSCU is not responsible for any errors in the external transfer instructions or requests for cancellation or change to instructions provided by you to MSCU.

Account Reconciliation

Inbound and outbound external transfers will be reflected on your MSCU periodic statement issued to you by us. You agree to notify us promptly of any discrepancy between your records and the information reflected in your periodic statements. If you fail to notify us of any such discrepancy within the time period, you will be precluded from asserting the discrepancy against MSCU.

ELECTRONIC DELIVERY OF STATEMENTS AND NOTICES

By accepting the Agreement", you consent and agree that MSCU may provide certain disclosures and notices to you in electronic form, in lieu of paper form, including electronic delivery of statements (eStatements) for your Bank account(s).

Disclosures that may be delivered to you electronically include, but are not limited to:

Periodic account statements

• Tax forms

• Change-in-terms notifications about your account

• Enclosures generally provided with a paper statement, and

• Other disclosers we are required or fell are prudent to provide.

What Your Acceptance and Agreement Mean

You have provided us with an email address that will be used to send you notifications as to the availability of certain eStatements. You will let us know immediately if this email address changes (see Contact Information below). You understand that you have no expectation of privacy if you are using an email address used by multiple parties or owned by your employer. You further agree to release MSCU from any liability if the information is intercepted or viewed by an unauthorized party at your employer or other email address selected by you.

Using the email address you provide, we will send you notifications as to the availability of these records when applicable (for example at the end of each statement cycle) and you will be required to access MSCU’s Online Banking in order to view them. If you do not provide an email address to us, we will not send a notification and it will be your responsibility to ensure you check this site periodically. Periodic statements for example are generally available within seven (7) days after the close of the statement cycle. Other notices are sent out as appropriate.

You will be required to enter your online banking login and password to view your eStatements. It is solely your responsibility to protect your login and password from unauthorized persons.

If you have agreed to Electronic as your Delivery Preference, you will generally not receive these records in paper form but may request them at any time (see Contact Information below). A fee may apply. See our Fee Schedule for details.

You agree it is reasonable to expect there will likely still be important documents sent to you via the USPS. You having selected electronic as your preferred delivery method does not impact your obligation to maintain a current mailing address with MSCU and open all MSCU mailings in a timely manner.

MOBILE BANKING

MSCU Mobile Banking Services provide you the ability to access information in your MSCU accounts and to conduct certain transactions using compatible and supported mobile devices.

Mobile Banking Service Limitations

MSCU and its service providers cannot always foresee and are not responsible for technical or other difficulties relating to the Mobile Banking Services. Such difficulties may result in the loss of data or personalization settings or other interruptions in service.

We will not be liable to you for any losses caused by your failure to properly use Mobile Banking on your Mobile Device. We reserve the right to refuse to make any transaction you request through Mobile Banking for any reason. You agree and understand that Mobile Banking may not be accessible or may have limited utility over some mobile networks, such as while roaming.

MOBILE DEPOSIT

Ineligible Items

You agree to scan and deposit only Checks as that term is defined in Federal Reserve Regulation CC ("Reg CC"). You agree that you will not use the Services to scan and deposit Checks or items that:

• Are payable to any person or entity other than you;

• Contain obvious alternation to any of the fields on the front of the Check, or which you know or suspect, or should know or suspect, are fraudulent or otherwise not authorized by the owner of the account on which the Check is drawn;

• Are drawn on a financial institution located outside the United States;

• You know are or suspect to be altered or fraudulent in any way;

• Are not payable in United States currency;

• Are dated more than six (6) months prior to the date of deposit or has a future date;

• Checks payable jointly, unless deposited into an account in the name of all payees;

• Traveler’s Checks;

• US Postal Money Orders;

• US Savings Bonds;

• Are in violation of any federal or state law, rule or regulation; or

• Otherwise not acceptable under the terms of the MSCU account.

Image Quality

The image of an item transmitted to MSCU using the Services must be legible and contain images of the front and back of the Check. The image quality of the items must comply with the requirements established from time to time by the American National Standards Institute ("ANSI"), the Board of Governors of the Federal Reserve Board, or any other regulatory agency, clearing house or association. These requirements include, but are not limited to, ensuring the following information can clearly be read and understood by sight review of the Check image: the amount of the Check (both written and numeric); the payee; the signature of the drawer (maker); the date; the Check number; the information identifying the drawer and the paying financial institution that is preprinted on the Check including the MICR line and all other information placed on the Check prior to the time an image of the Check is captured (such as any required identification written on the front of the Check and any indorsements applied to the back of the Check).

Your Responsibility

You are solely responsible for the quality, completeness, accuracy, validity and integrity of the image. You are solely responsible if you, intentionally or unintentionally, submit fraudulent, incorrect or ineligible images to us or if the Mobile Device is used, by authorized or unauthorized persons, to submit fraudulent, unauthorized, inaccurate, incorrect or otherwise improper or unusable images to us.

Indorsements

You agree to restrictively indorse any item transmitted through the Services as "Your name, Mobile Deposit at MSCU Only" or as otherwise instructed by MSCU.

Receipt of Deposit

We reserve the right to reject any item transmitted through the Services, at our discretion, without liability to you. We are not responsible for items we do not receive or for images that are dropped during transmission. An image of an item shall be deemed received when you receive a confirmation from MSCU that we have received the image. Receipt of such confirmation does not mean the transmission was error free or complete. Following receipt of such confirmation, MSCU will process the image by preparing a "Substitute Check" or clearing the item as an image. We further reserve the right to charge back to your account at any time; any item that we subsequently determine was not an eligible item. You agree that MSCU is not liable for any loss, costs, or fees you may incur as a result of MSCU’s chargeback of an ineligible item.

Presentment

The manner in which the items are cleared, presented for payment and collected shall be at MSCU's sole discretion subject to the Deposit Agreement and Disclosures governing your account.

Deposit Limits

Limits on deposits are $2,000 maximum per single item deposit and $4,000 maximum per day. We reserve the right to impose limits on the amount(s) and/or number of deposits that you transmit using the Services and to modify such limits from time to time.

Items Return Unpaid

Any credit to your Account for checks deposited is provisional. If original checks deposited through Mobile Check Deposit are dishonored, rejected or otherwise returned unpaid by the drawee bank, or are rejected or returned by a clearing agent or collecting bank, for any reason including, but not limited to, issues relating to the quality of the image, you agree that an original check will not be returned to you, but that we may charge back the amount of the original check and provide you with an image of the original check, a paper reproduction of the original check or a substitute check. You will reimburse MSCU for any and all losses, costs, damages or expenses caused by or relating to the processing of the returned item. Without our approval, you shall not attempt to deposit or otherwise negotiate an original check if it has been charged back to you. We may debit any of your accounts to obtain payment for any item that has been rejected or returned, for any adjustment related to such item or for any warranty claim related to such item, whether or not the rejection, return, adjustment or warranty claim was made timely.

Errors

You agree to notify MSCU of any suspected errors regarding items deposited through the Services right away, and in no event later than sixty (60) days after the applicable MSCU account statement is sent. Unless you notify MSCU within sixty (60) days, such statement regarding all deposits made through the Services shall be deemed correct, and you are prohibited from bringing a claim against MSCU for such alleged error.

Disposal and Retention of Items

Retain the physical Check that was deposited in a secure location until the deposit has posted to your account (allow at least 14 business days), then shred the Check. You agree to never represent the item.

Guarantee Specific to Deposits Received for Credit to a Business Account

Your use of the Services for the purpose of depositing to a Business Account constitutes your understanding and agreement that you may be personally liable for any expense MSCU incurs in attempting to obtain final payment for the item in questions, outside of the routine costs associated with item processing, in the event of a default by the Business. This includes but is not limited to recovery of the amount credited in the event of non-payment, collection cots and attorney’s fees as applicable, as well as any and all costs associated with MSCU enforcing this Guarantee. This guarantee shall benefit MSCU and its successors and assigns.

Your Warranties: You Make the Following Warranties and Representations With Respect To Each Image

Each image is a true and accurate rendition of the front and back of the original check, without any alteration, and the drawer of the check has no defense against payment of the check. The amount, payee(s), signature(s), and indorsement(s) on the image and on the original check are legible, genuine, and accurate. You will not deposit or otherwise indorse to a third party the original item (the original check) and no person will receive a transfer, presentment, or return of, or otherwise be charged for, the item (either the original item, or a paper or electronic representation of the original item) such that the person will be asked to make payment based on an item it has already paid. There are no other duplicate images of the original check. The original check was authorized by the drawer in the amount stated on the original check and to the payee(s) stated on the original check. You are authorized to enforce each item transmitted or are authorized to obtain payment of each item on behalf of a person entitled to enforce such transmitted item.