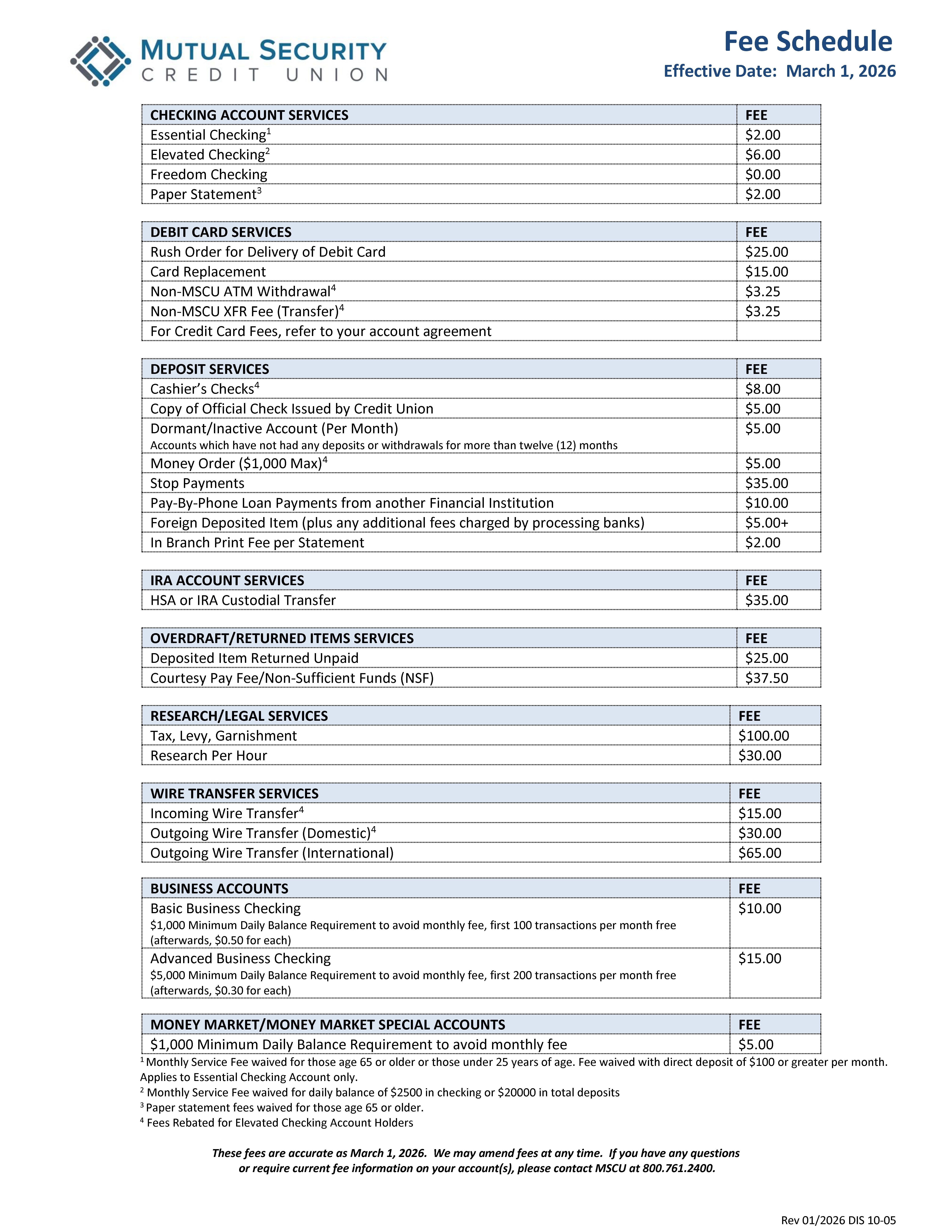

Fee Schedule

The following schedule describes the charges and fees that may be charged on your account(s).

We may amend fees at any time. If you have any questions or require current fee information on your account(s), please contact MSCU at 1-800.761.2400.